Brought to us by IGG Software, is a shiny personal finance application built for the Mac that claims to be “the Quicken Killer.” While I’m not sure if iBank poses the certain death of Quicken just yet, the idea is intriguing. Does iBank have what it takes to send Quicken whimpering back to Intuit? Or is it just another Mac-based financial app that looks pretty but that doesn’t quite get the job done? And how does iBank match up to other budgeting solutions available? In this review, I hope to find out. This review is for.

There is a newer version (4.2.5) now available. I’ll have a revised review of the newest version up as soon as possible. IBank’s New Features When you first visit the website you’re introduced to some of the new features (or at least the ones that iBank is most proud of).

Here’s a screenshot (click to enlarge): As you can see, there’s quite the list. If you click on ‘Full Feature List’ at the middle of the page, you can access a complete list of all the features that iBank has to offer. Some look like eye candy, but others look as though there has been some good thought put into designing the app. I’m excited to put many of them to the test. Downloading & Installing iBank Downloading and installing iBank was a piece of cake.

All you do is download the file and drag the application into your applications folder. It doesn’t get much simpler than that. Once you start iBank, it allows you to purchase it if you haven’t already done so. I opted to ‘Use Demo.’ It says that you are allowed 75 transactions in the system before you have to purchase it although the website mentions a 30-day trial period.

I’m assuming it’s whichever comes first. Setting Up iBank Once inside of I was presented with a nice ‘iBank Setup Assistant’ screen. It showed me new features for iBank 3, gave me an option to create a ‘New Document, and provided some support features.

What I really liked is that they had a ‘Quick Start Guide’ (unlike the similar application I recently reviewed). Clicking the link downloaded an 18 page pdf file. I found the quick start guide to be simple and easy to follow – just what a newbie will need. I was a bit hesitant at first about reading 18 pages, but found that it uses large text and plenty of large pictures. It’s an easy read and I highly suggest you check it out if this is your first time booting iBank up. It will make the process a lot quicker. I then chose, ‘New Document’ and saved a new iBank document to my desktop (you will likely want it somewhere more permanent if you intend on continuosly using it.

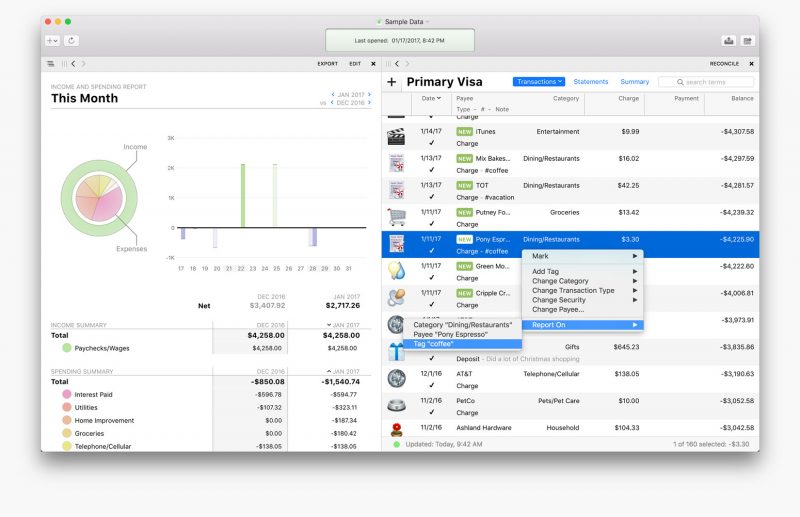

Double clicking the new document icon opens the iBank application. Main iBank Window As you can see, the main iBank window is clean and will feel very familiar to those used to using a Mac. At the top you’ll see your options for adding bank accounts, charts, budgets, and more. You’ll also see other tools such as Budget Monitor, Calculator and a couple others that I’ll go over later. The left panel houses your bank accounts that you put into iBank as well as ways to “manage” your finances. The middle section is the transaction window where you can see your transaction in either list, coverflow, or thumbnail view.

The bottom left houses a graphical representation of your expenses and the bottom right is where you enter your bank transactions manually. Adding an Account The Quick Start Guide does a good job of walking you through the basics of getting started. After reading it, I basically followed the same steps, so what you read here is simply my experience with the process they laid out for me. After clicking on the Account icon at the top left, you’re presented with a basic screen to input your account details such as name, beginning balance, account type, etc. One feature here is the Min. Balance that allows you to put a minimum balance for the account. If your balance goes below that point, you will get warned.

Since I will be inputting and importing transactions for purposes of the review, for my beginning balance I put what my bank balance was about 20 or transactions ago (if you don’t want to import all the transactions since your account’s inception, you may want to do the same). Direct Downloading of Transactions It then allowed me to choose to enable transaction downloading from my bank. There are different schools of thought on this subject. I personally believe that the act of manually inputting your transactions each weak or so reinforces your spending awareness and helps in the budgeting process. I do, however, recognize the convenience of having transactions automatically downloaded. I chose to allow it. After inputting my username, password, account number and routing number, it wouldn’t connect to my bank.

This may be due to the fact that my bank is using some other username than the one I use to login online, or it may just not be working with my bank. At any rate, I’ll update the post if/when I can get it to work. Adding Transactions in iBank Adding transactions in the list, thumbnail, or coverlfow view is pretty much the same. It’s generally pretty simple and easy. It’s not as fast as other applications that I’ve seen simply because you have click the + symbol for every new transaction.

/iBank-4-Accounts-56a2f0c15f9b58b7d0cfd0fd.jpg)

This might not seem like a big deal, but when you’re inputting a bunch of transactions, it gets old (I only did about 10 transactions and I was sick of having to move to my mouse). It’s a big improvement, however, on Cha-Ching’s transaction editor because you can actually tab through to each input field. This allows you to input all the information you need to using only the keyboard. I also like that the category auto fills as you type, but I noticed that you have begin typing the exact category in order to work. For example, when I started typing “Meals” for the “Dining:Meals” category, it didn’t find it.Note: Almost every time I tried to scroll through the categories while editing the transaction, it froze for about 8-10 seconds. A small bug, that iBank will likely get fixed before too long.

Creating Custom Categories I was pleased to see that you can create your own custom categories in. Your budget is something that’s personal to you, and as such, you need software that will allow you to create your own categories for spending. Creating a category in iBank is fairly simple. Just click on the Categories folder below the area where the Accounts are listed. This opens a list of all the categories. Click the + icon and add your own. You can also choose it’s custom color to help you in your charts, etc.An interesting feature that I found by accident: When you input your category – if you put anything after a colon (:) it becomes a child category to the main category that you’re creating.

For example, I typed in “Fun Money: Hers” and it created a main category “Fun Money” and a child category “Hers.” I like it. Splitting Transactions Another essential piece to any personal finance software is the ability to split transactions.

Doing so it iBank is fairly easy, although not quite as streamlined as other solutions I’ve seen. A Thought about Coverflow and Thumbnail Views It’s only my personal opinion, but I don’t see how the coverflow feature adds any value whatsoever to the financial application.

Sure, it’s pretty and fancy. But what does it do to help me manage my finances better? It is nice that iBank has some good looking icons already in the software for certain categories (and you can add your own using your iSight camera if you wish), which is an improvement upon Cha-Ching.

But the fact still stands that it’s a waste of time to worry about such things. The only worthwhile application that I could see with this feature is to take a picture of your receipt and attach it to the transaction if you’re the kind that keeps track of receipts. Oh, and the thumbnail view isn’t as bad, but still seems like it takes up too much space. Just some thoughts. IBank’s Charts What is often called the reporting or analysis section of other personal finance software, calls Charts. And probably rightly so since it’s basically a number of charts that you can custom create.

You add a chart by clicking the Chart icon at the top left of the iBank appliation. It asks you to create a name for your new chart and select the time frame and type of chart that you’d like. Options are:. Balance Sheet.

Capital Gains. Custom. Quick Summary. ROI (Return on Investement) I created a Quick Summary and was then given this chart (click to enlarge): My first impression was: cluttered. The graph itself was fine, but it was all the information in the panels around it that made me a little claustrophobic.

On this particular graph you can view the transactions for each category by double clicking it’s piece of the pie. The middle section allows you to list which categories you’d like in your graph. They also have an option to get a printout report of the chart you’ve selected. By clicking Generate Report at the bottom it spits out a pretty official looking report. In addition, you have the option of viewing your chart in the following ways: By Category, Through Time, Cateogry & Date, and Transactions. I’ll let you be the judge on the charts section. Overall, I wasn’t super impressed, but that’s just my personal opinion.

On a positive note, however, if you put in some time and created some good custom reports that you felt helped you better manage your money, iBank’s charts may be helpful. IBank’s Budget Now for what I feel is the most important section of any personal financial application – the budget. I say this because this is where I feel most of the activities are that actually can have a great impact on the way that one manages their finances. I’ve seen this done beautifully (the envelope method used by Mvelopes and YNAB) and I’ve seen it done very poorly (Mint comes to mind).

How does iBank’s budget stand up to the competition? Let’s take a look. Again, to add a budget you simply click on the Add Budget icon at the top left. After naming your budget you are presented with the screen to enter in your budgeted amounts for each category. There is a top section for Income and bottom section for Expenses. Simple enough.

To add a budget for a category, click the + symbol in the bottom of the respective windows. You then change the category for the new expense (the default is Vacation: Lodging – not sure why) by clicking the category and selecting the one you want from the drop down menu. You can make the expense be budgeted weekly, every two weeks, monthly, quarterly, or annually. Double-click, or tab, to enter the amount. A Note About Budgeting in this Manner I wanted to quickly point out something about the method that iBank uses to help you budget. In iBank’s budget (and most other financial applications for that matter) when you set up your budget you can choose only the categories that you want to budget for. This is nice, customizable, and convenient right?

Well, yes and no. It’s convenient, but not very effective. One of the main goals of a budget is to catch the money that’s falling through the cracks from untracked, forgotten, ignored, or unplanned-for expenses.

So when you aren’t tracking all of your spending in all of your categories, you can see how this problem is likely to continue. That’s why I am such a proponent of the envelope budgeting methodology – because it forces you to be accountable for every dollar that you spend in every category. So if you do choose to use, may I suggest that you create a budgeted amount for each category that you spend out of. This will take some extra discipline since it’s not encouraged much in iBank, but the result will be better money management.

IBank’s Budget Monitor After having set up your budget, you’re now ready to use the Budget Monitor to keep up on your budget. To open it up, simply click the Budget Monitor icon at the top. You’re presented with a screen that shows you a bar graph for each category showing your spending (for whatever time frame you choose in the top right). For some reason my Budget Monitor was quite small and cramped together (see picture). You can (and probably will need to) resize the window and the columns to make it a bit more legible and eye-friendly. It’s nice that you’re able to do so.

To be frank, I was actually somewhat dissapointed in the budgeting feature of iBank. This commonly seen bar graph is fine (and I like that iBank also includes the amount spent and budgeted figures to the right of the graph. It illustrates how much you’ve spent in relation to your budgeted amount. But if that’s all that it does, I don’t see how this truly reinforces the fact that if I spend too much in the entertainment category (which I did in the pictures above), I now have less money to spend in other categories. Also the graph doesn’t do much to show me how much I’ve overspent. The graph shows up the same (full and red) whether I’ve overspent by $1 or by 5 times the amount I budgeted for (see the image above). I also don’t quite understand why each category needs to have an Income column.

I don’t think it’s very likely that I will have many incoming transactions for the Groceries category. To iBank’s credit, they’re not using the envelope method of budgeting and so it’s not designed to enforce those kinds of rules. It’s not so much the design that I fault, but rather it’s the lack of true budgeting power that you find with more effective budgeting systems/methodologies. A Few Other iBank Features There are a few other features that I’d like to highlight, but won’t go into too much detail on.

Forecast – There’s a Forcast feature that allows you to forecast your future financials based on scheduled transactions, average of previous balances, or both. Being that I didn’t have much data in the system I wasn’t able to fully test the feature, but I suspect that it will work just fine for those looking for such a thing. Smart Import Rules – As you might expect, this allows you to set rules as to how your imported bank data appears in the transaction registry.

This is a great and very worthwhile feature. Scheduled Transactions – iBank does allow you to schedule regular transactions without much difficulty. Get Quotes – I was unable to test it, but it appears that you can get up to date quotes on holdings in your investment portfolio.

Tax Handling – iBank does allow you to input certain data pertaining to taxes for each transaction. You can then export this info come tax time to help with your tax accounting. X-assist 0.8.1 free download for mac. IPhone Sync – If you have a MobileMe account, you can view and edit your transactions on your iPhone.

IBank’s Dashboard Widget And of course, any Mac application wouldn’t be complete without it’s own dashboard widget right? I downloaded the iBank widget from apple.com to try it out. Here’s what it looks like: Essentially all that the widget does is allow you to enter a transaction without having the iBank application up and running. It also gives you a balance and plays a fun little “Cha Ching” noise as you enter the transaction. I can certainly see how one would appreciate such a widget if they were using iBank on a regular basis. It worked just fine for me – when I logged back into iBank, there were my two new transactions in the register. IBank’s Price To purchase iBank, it will cost you $59.99.

If you find that you like the iBank system, that’s a very decent price. What really matters is that it helps you to better manage your money. If so, it will pay for itself many times over. I do think, however, that there are more effective solutions in the market for $60 (or even cheaper) that will have a greater impact on your budgeting. Free Trial – As mentioned, they offer a 30-day free trial.

Review: Ibank 4 For Mac Download

So you might as well give it a spin to see if it’s something that you’ll like. IBank Overall Conclusion IGG Software has done a good job in the development of. I found almost no bugs and it did everything that I expected it to do. It’s very Mac friendly and is much better than it’s competitor, Cha-Ching. It has a very clean interface and you can tell the developers have thought quite a bit about the actual usability of the app. Will iBank revolutionize your finances?

Ibank Corporation Reviews

If you’re not currently tracking your spending, than it will certainly help. There are, however, other personal finance software applications out there that will do a better job of helping you to create solid spending plans and help you stick with a more comprehensive budget. Taking a more proactive approach with your budget will do wonders for your financial situation.